This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

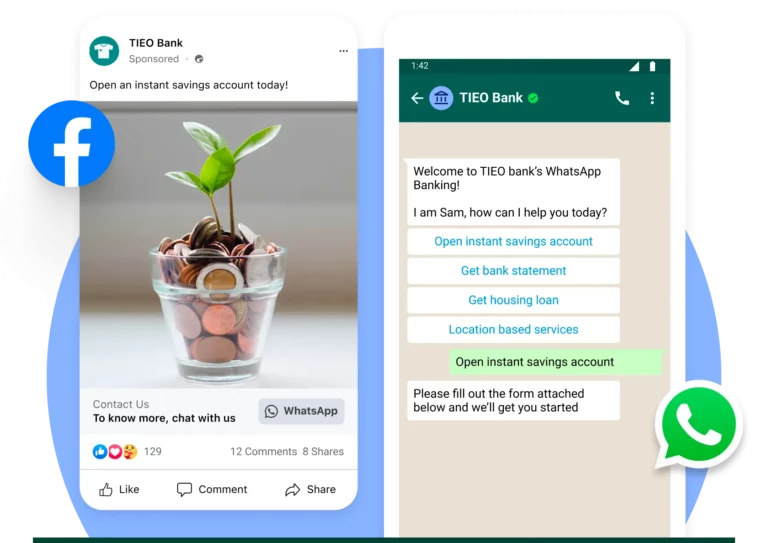

Enhance Customer Experience with WhatsApp for Banking and Finance

- Streamline KYC Processes: Conduct ID verification, document validation, and other KYC steps seamlessly on WhatsApp.

-

Provide 24/7 Customer Support: Respond to customer queries instantly, ensuring round-the-clock

assistance. - Showcase Your Financial Offerings: Use a WhatsApp storefront to highlight products and services, driving customer engagement.

3X

Read rate as compared to SMS

50%

Reduction in cost per lead

7-8 M

Users check credit score on WhatsApp

90%

Average open rate on WhatsApp broadcasts and notifications

Drive Faster Conversions with Conversational Commerce on WhatsApp

- Generate and Qualify Leads: Use timely greeting messages and follow-ups on WhatsApp to verify and engage potential customers.

- Automate Lead Follow-Ups: Save time by automating follow-ups with leads and prospects to keep the conversation going.

- Provide Personalized Financial Assistance: Offer tailored guidance on loan applications, mutual funds, other financial services to enhance buying experience.

Minimize Drop-Offs and Retain Customers with WhatsApp for Financial Services

- Seamless Customer Onboarding: Use WhatsApp interactive messages to guide customers through an easy and efficient onboarding process.

- Gather Personal Information Effortlessly: Collect necessary details and lead customers to the next step in their financial journey with personalized messaging.

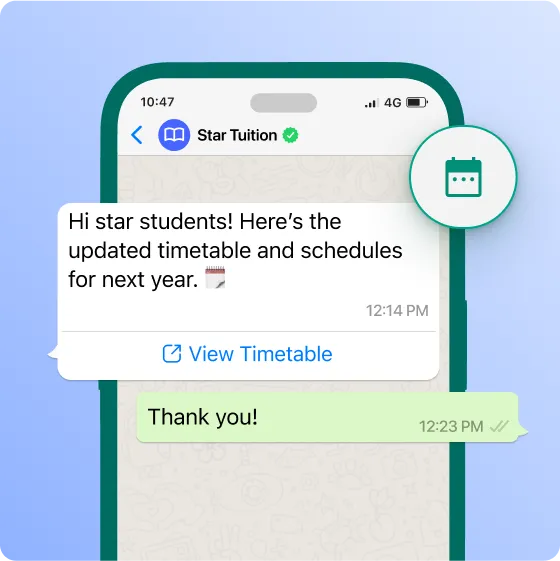

- Share Product Information: Deliver detailed insights about your products and services using PDFs, videos, and other engaging content formats.

Deliver Exceptional Post-Purchase Support to Build Brand Loyalty

- Send Payment Reminders: Keep customers informed with timely notifications for recurring payments.

- Provide Alerts on Limits: Notify users about transfer limits to ensure seamless transactions.

- Assist with Account Details: Offer quick support for account information, interest rates, and other queries.

- Simplify Account Updates: Make account information updates and password resets hassle-free.

- Share Digital Documents: Deliver invoices, e-policies, and e-receipts securely via WhatsApp.

- Manage Credit Card Services: Assist customers with blocking, renewing, or upgrading credit cards with ease.

Supercharging B2B businesses with Whatsapp automations

Clients Feedback

Our Client Reviews

Don’t take our word for it. Read the below-mentioned testimonials to know the quality of our service.

“Evergrow Digital transformed our customer communication. Our booking confirmation rate jumped by 35%, and the WhatsApp automation lets us provide real-time travel updates to clients—a feature they love.

“Integrating Evergrow Digital’s WhatsApp tools into our real estate operations has been a game-changer. Inquiry response times dropped by 50%, and we’ve seen a 30% rise in property viewings just from automated follow-ups.

“Since partnering with Evergrow Digital, our customer engagement rates have increased by over 40%. The WhatsApp automation lets us reach our diners personally, leading to more repeat bookings and a smoother experience.

“Evergrow Digital’s WhatsApp solution brought our average response time down by 60%. Customer satisfaction scores rose by 25%. Platform has made a noticeable difference in the way we interact with customers—it’s faster and organized.

“Using Evergrow Digital’s WhatsApp campaigns, we saw open rates hit 90%—far surpassing email. Our click-through rates also went up by 35%, driving real engagement and boosting our sales.

“With Evergrow Digital’s WhatsApp CRM, our B2B outreach response rates increased by 50%. Tracking client conversations has never been this efficient, and our relationship-building efforts are visibly stronger.

“Evergrow Digital’s WhatsApp tools boosted our campaign engagement by 45% while saving our team over 15 hours a week. It’s enabled us to focus on big-picture strategies and connect with our audience more directly.

Frequently Asked Questions

WhatsApp uses end-to-end encryption, ensuring all communications, documents, and customer data are safe and secure, making it suitable for sensitive financial interactions.

Yes, you can share e-policies, invoices, account statements, and receipts securely through WhatsApp, providing a paperless and convenient experience for customers.

WhatsApp allows you to handle credit card services, including blocking, renewal, and upgrades, through automated and real-time messaging.

Faster lead generation and qualification.

Seamless customer onboarding and KYC processes.

Enhanced customer engagement through personalized messages.

Secure communication for account management and financial services.

Reduced churn with reminders and proactive support.

WhatsApp uses end-to-end encryption, ensuring all communications, documents, and customer data are safe and secure, making it suitable for sensitive financial interactions.

Yes, you can share e-policies, invoices, account statements, and receipts securely through WhatsApp, providing a paperless and convenient experience for customers.

WhatsApp allows you to handle credit card services, including blocking, renewal, and upgrades, through automated and real-time messaging.

Faster lead generation and qualification.

Seamless customer onboarding and KYC processes.

Enhanced customer engagement through personalized messages.

Secure communication for account management and financial services.

Reduced churn with reminders and proactive support.

Yes, you can use WhatsApp broadcasts to promote financial products like loans, mutual funds, or investment plans. Sharing product videos and brochures can drive customer interest.

You can automate recurring payment notifications to remind customers about upcoming EMIs, loan repayments, or subscription fees, reducing missed payments.

Financial institutions can integrate WhatsApp using the WhatsApp Business API, allowing seamless synchronization with CRM tools to manage customer data and automate workflows.

By offering timely updates, personalized support, and a secure platform for communication, WhatsApp helps build trust and loyalty, ensuring long-term customer relationships.

es, WhatsApp enables easy account information updates and password reset requests, ensuring a smooth and secure process for customers.